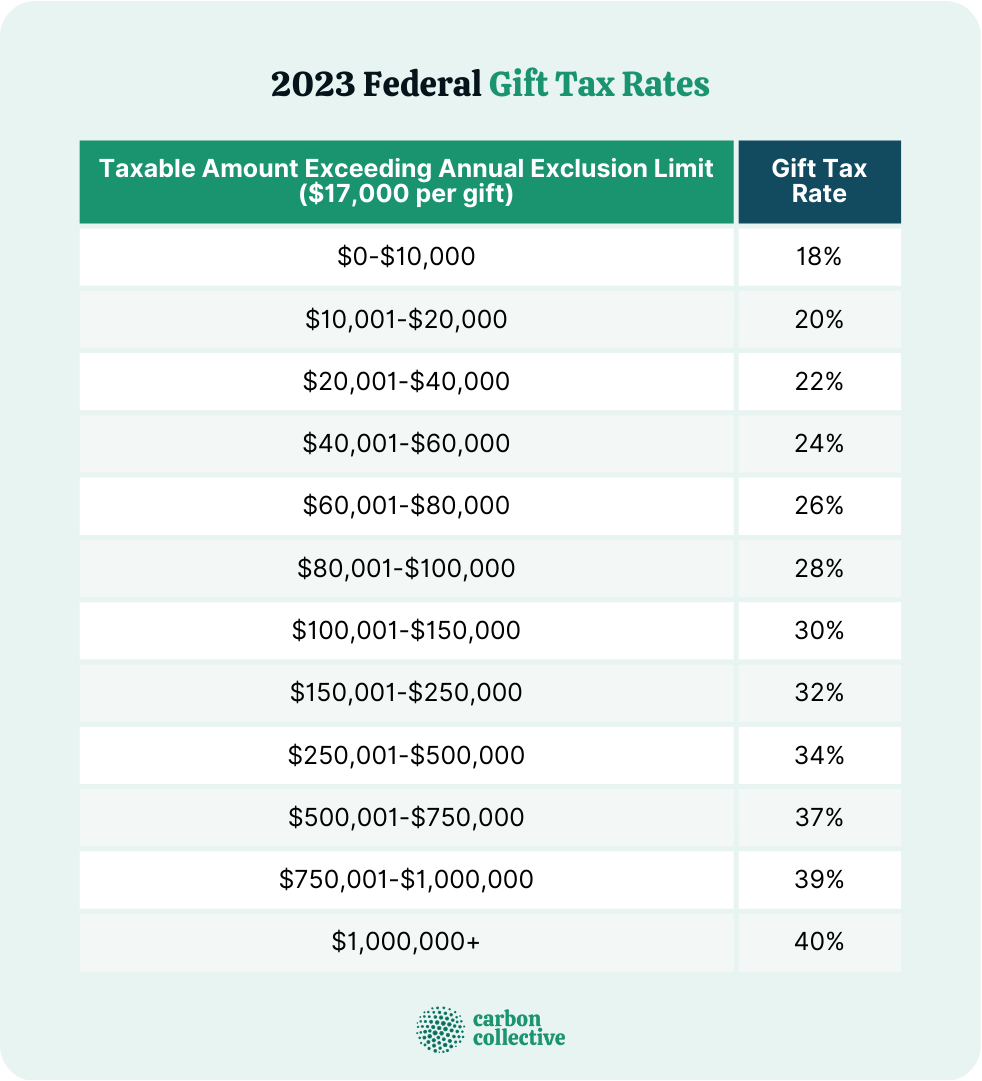

Gift Tax Amount For 2025 - Amounts gifted beyond the annual gift exclusions and beyond the lifetime. But even if you exceed that amount, there are some. Fewer taxpayers are subject to gift taxes thanks to a $12,920,000.00 lifetime gift tax exemption for 2023.

Amounts gifted beyond the annual gift exclusions and beyond the lifetime. But even if you exceed that amount, there are some.

Gift Tax Amount For 2025. However, the income tax act, 1962 includes key provisions which allow you to receive various. The gift tax is intended to discourage large gifts that could.

Will Changes To The Tax Law Be Retroactive?, Gifts are of three types monetary (like cash), immovable property, and movable property, calculate. Tds is levied on many types of incomes like salary, house rent, virtual digital assets (vda), etc.

Estate taxes and gift taxes, how do they impact medicaid? John Ross, The gift tax imposes a. But even if you exceed that amount, there are some.

What are the Gift Tax Limits for 2023?, Amounts gifted beyond the annual gift exclusions and beyond the lifetime. What it is, how it works and who has to pay it.

Current Events February 2025. Here are the science & technology news. Infoplease has got you […]

Gift Taxes Gift Limit, Gift Tax Rate, Who Pays IRS and More Wiztax, And with the new financial year beginning soon, taxpayers would again be required. For 2025, the annual gift tax limit is $18,000.

Annual gift tax exclusion amount increases for 2023 Merline & Meacham, PA, Because many taxpayers do not fall under the exemption. 1 for 2025, the limit has been adjusted for inflation and will rise to $18,000.

Red Cup 2025. The second edition of leagues cup will take place from friday, july […]

As of march 2025, it looks like the 2025 lifetime gift tax exemption amount.

Gift Tax Limit 2023 Explanation, Exemptions, Calculation, How to Avoid It, Tds is levied on many types of incomes like salary, house rent, virtual digital assets (vda), etc. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.